“With the comprehensive restoration of normalized operation of the economy and society, macroeconomic policies have shown significant effectiveness and effectiveness, and various policy measures have promoted the overall improvement of the economy and the steady progress of high-quality development. However, in the current stage of economic operation, there are still many difficulties and challenges, with many risks and hidden dangers in key areas, and a complex and severe external environment. While developing with high quality, the rare earth industry actively responds to risks and challenges, gathers strength, overcomes difficulties, and promotes mutually beneficial and win-win cooperation among rare earth entity enterprises through trading platforms, actively coordinates the upstream and downstream industry chain, and expands and strengthens the rare earth industry through green, low-carbon, digital, and information-based development.”

01

Macroeconomics

This week, the Federal Reserve raised interest rates by another 25 basis points, reaching the highest level since 2001. The economy has expanded moderately, and the US China interest rate gap has been reversed. The possibility of a rate cut this year is relatively small, and there is still a possibility of a rate hike in the fourth quarter. This rate hike has intensified the adjustment of the international financial market.

The Ministry of Industry and Information Technology recently stated that it will make every effort to promote stable industrial growth, promote and implement the work plan for stable growth in key industries, study and promote policy measures for technological transformation, improve the regular communication and exchange mechanism with enterprises, better leverage the joint efforts of various policies, stabilize enterprise expectations, and boost industry confidence.

02

Rare earth market situation

In early July, the price trend of the previous month continued, and the overall performance of the rare earth market was poor. Rare earth prices were operating in a weak manner, resulting in a decrease in both production and demand. The supply of raw materials was tight, and there were few enterprises in stock. Terminal enterprises replenish goods as needed, and prices continue to decline due to insufficient upward momentum.

Starting from the middle of the year, due to multiple factors such as group procurement, Myanmar customs closures, tight summer power supply, and typhoons, product prices have started to rise, market inquiries have been positive, transaction volume has increased, and merchant confidence has been reshaped. However, the prices of metals and oxides are still upside down, and metal factories have limited inventory and can only produce on lockdown orders to correspond to price increases. The order growth of the magnetic material factory is limited, and there is still a need to replenish the goods, resulting in a weak willingness to purchase.

At the end of the month, both market inquiries and trading volume decreased, which may indicate the end of this round of upward trend and the overall weakening of market operations. Based on past experience, the "Golden Nine Silver Ten" season is a traditional peak season for sales, and terminal orders are expected to increase. Enterprise production needs to be restocked in advance, which may drive up rare earth prices in August. However, at the same time, attention should also be paid to policy guidance and changes in market supply and demand. There is still uncertainty in rare earth prices in August.

The overall performance of the rare earth waste market in July was lackluster, with prices falling at the beginning of the month, exacerbating the inversion of profits and costs. The enthusiasm of enterprises for inquiries was not high, while the production of magnetic materials was low, resulting in less waste production and scarce supply, making enterprises more cautious in receiving goods. In addition, the import volume of rare earths has increased this year, and the supply of raw materials is sufficient. However, the prices of rare earth waste recycling remain high, putting great pressure on recycling enterprises. Some waste separation enterprises have stated that the more processing they make, the more losses they will incur. Therefore, it is better to suspend material collection and wait.

03

Price trends of mainstream products

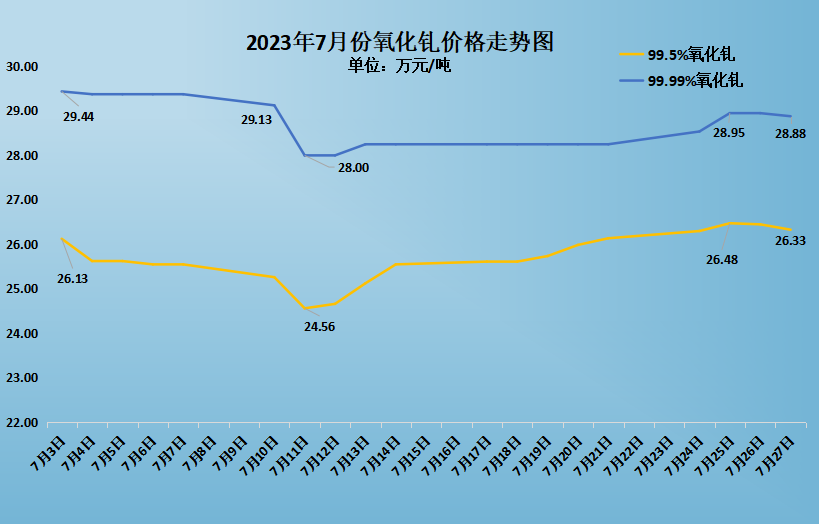

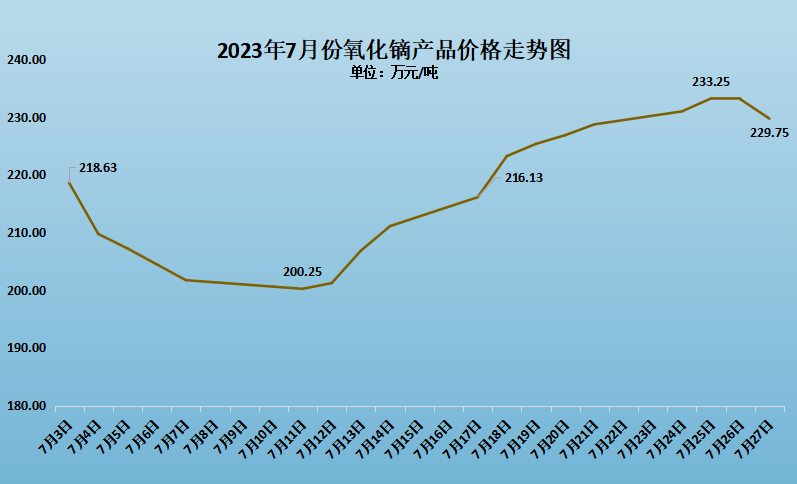

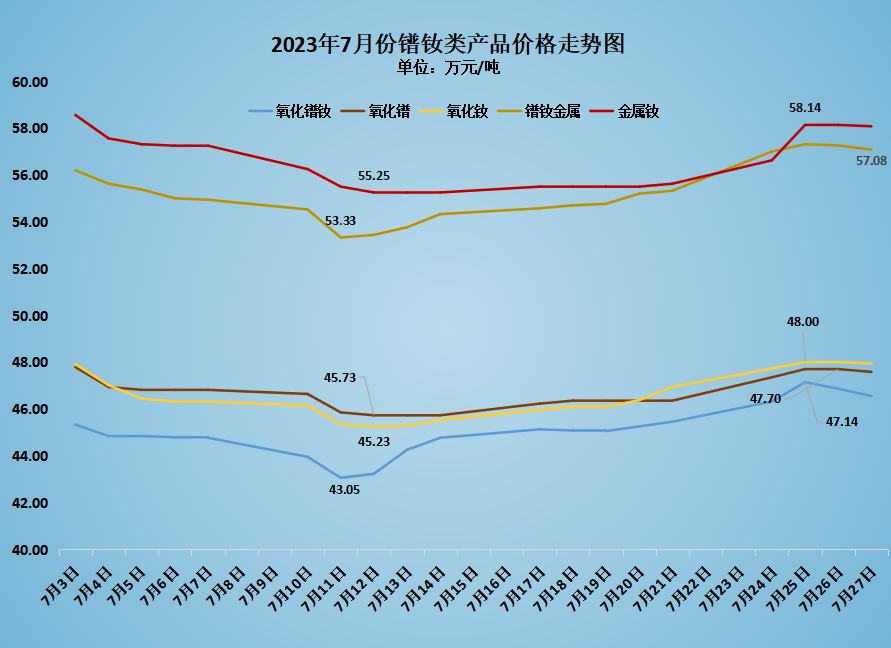

The price changes of mainstream rare earth products in July are shown in the figure above. The price of praseodymium neodymium oxide increased from 453300 yuan/ton to 465500 yuan/ton, an increase of 12200 yuan/ton; The price of metal praseodymium neodymium increased from 562000 yuan/ton to 570800 yuan/ton, an increase of 8800 yuan/ton; The price of dysprosium oxide increased from 2.1863 million yuan/ton to 2.2975 million yuan/ton, an increase of 111300 yuan/ton; The price of terbium oxide decreased from 8.225 million yuan/ton to 7.25 million yuan/ton, a decrease of 975000 yuan/ton; The price of holmium oxide decreased from 572500 yuan/ton to 540600 yuan/ton, a decrease of 31900 yuan/ton; The price of high-purity gadolinium oxide decreased from 294400 yuan/ton to 288800 yuan/ton, a decrease of 5600 yuan/ton; The price of ordinary gadolinium oxide increased from 261300 yuan/ton to 263300 yuan/ton, an increase of 2000 yuan/ton.

04

Industry Information

1

On July 11th, data released by the China Association of Automobile Manufacturers showed that in the first half of 2023, the production and sales of new energy vehicles in China reached 3.788 million and 3.747 million, respectively, with year-on-year growth of 42.4% and 44.1%, and a market share of 28.3%. Among them, the production and sales of new energy vehicles in June reached 784000 and 806000, respectively, with year-on-year growth of 32.8% and 35.2%. According to data released by the China Association of Automobile Manufacturers, China exported 800000 new energy vehicles in the first half of the year, a year-on-year increase of 105%. The new energy vehicle industry continues to develop well.

2

Recently, the Ministry of Industry and Information Technology and the National Standardization Commission jointly released the "Guidelines for the Construction of the National Automotive Internet Industry Standard System (Intelligent Connected Vehicles) (2023 Edition)". The release of this guide will promote the rapid verification and implementation of intelligent driving technology, as well as the integration of upstream and downstream industries, and usher in the era of popularization of intelligent driving. After in-depth analysis of the new demands and trends in the intelligent connected vehicle industry, the standard system formed has laid a solid foundation for the high-quality development of the intelligent connected vehicle industry. It is expected that various car companies will increase their promotional efforts in the third quarter, and with policy support, market sales are expected to maintain a growth trend in the second half of the year.

3

On July 21st, in order to further stabilize and expand automobile consumption, 13 departments including the National Development and Reform Commission issued a notice on "Several Measures to Promote Automobile Consumption", which mentioned strengthening the construction of supporting facilities for new energy vehicles; Reduce the cost of purchasing and using new energy vehicles; Implement policies and measures to continue and optimize the reduction and exemption of new energy vehicle purchase tax; Promote the increase of new energy vehicle procurement in the public sector; Strengthen automobile consumption financial services, etc. The Ministry of Industry and Information Technology and the State Administration of Market Regulation have also pointed out that China's new energy vehicle industry has entered a new stage of rapid and large-scale development. Production enterprises are the first responsible person for product quality and safety. They should take risk prevention measures throughout the entire chain of product development and design, production and manufacturing, testing and verification, effectively fulfill legal obligations such as product quality accident reporting and defect recall, continuously improve product safety levels, and resolutely curb the occurrence of new energy vehicle safety accidents.

4

Driven by the rapid development of new energy power generation, the new installed capacity of power generation in China is expected to exceed 300 million kilowatts for the first time in history. The temperature in most parts of the country is relatively high this summer, and it is expected that the highest electricity load in the country will increase by 80 million kilowatts to 100 million kilowatts compared to 2022. The actual increase in stable and effective supply capacity is lower than the increase in electricity load. It is expected that during the peak summer period of 2023, the overall balance of electricity supply and demand in China will be tight.

5

According to statistics from the General Administration of Customs, the import volume of rare earth minerals and related products in June 2023 was 17000 tons. Among them, the United States has 7117.6 tons, Myanmar has 5749.8 tons, Malaysia has 2958.1 tons, Laos has 1374.5 tons, and Vietnam has 1628.7 tons.

In June, China imported 3244.7 tons of unnamed rare earth compounds and 1977.5 tons from Myanmar. In June, China imported 3928.9 tons of unnamed rare earth oxide, of which Myanmar accounted for 3772.3 tons; From January to June, China imported a total of 22000 tons of unnamed rare earth oxide, of which 21289.9 tons were imported from Myanmar.

At present, Myanmar has become the second largest importer of rare earth minerals and related products, but it has recently entered the rainy season and there have been landslides in mines in the Banwa region of Myanmar. It is expected that the import volume may decrease in July. (The above data comes from the General Administration of Customs)

Post time: Aug-15-2023